Can I Sell My Car Under Finance?

Many people wonder if they can sell with a secured car loan. In this article, we will explain what you need to know about selling a financed car. We will cover how to settle your loan, avoid common mistakes, and make the process easy.

Can I Sell My Car with an Outstanding Loan?

The Short Answer

Yes, you can sell a car with outstanding finance, but the loan must be settled first. Get a payout figure from your lender and share it with the buyer, who can pay the loan directly if need be. Any leftover funds go to you, but if the sale price doesn’t cover the loan, you’ll need to pay the difference. Once the loan is cleared, confirm with the lender and complete the sale.

What Does Encumbered Mean?

An encumbered car has a financial obligation, typically a loan, making it collateral. The seller must clear the debt before transferring ownership to avoid passing on the obligation. To see if your vehicle is encumbered, purchase a PPSR report from ppsr.gov.au

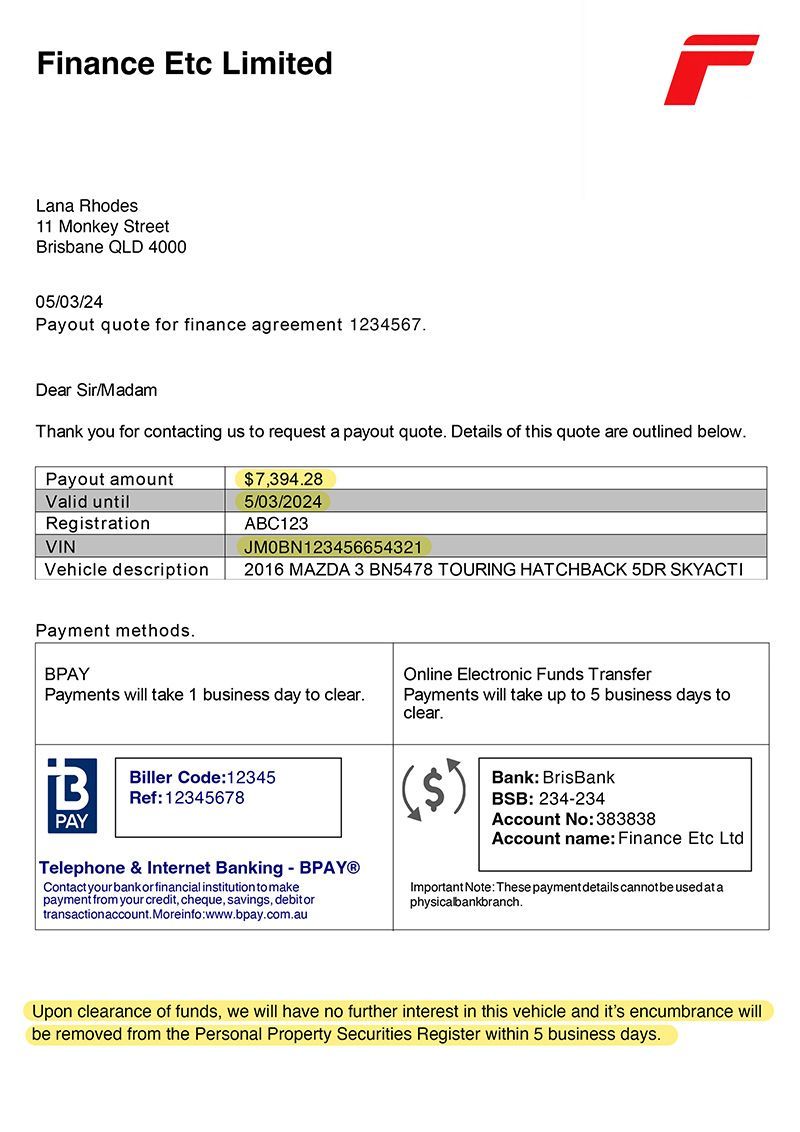

What is a Payout Letter?

A payout letter is a formal document from a lender. It shows the amount needed to fully pay off a loan or finance agreement. It includes key details like the final balance, any interest or fees, and instructions for making the payment.

People often need this letter when selling a financed vehicle. It ensures that the borrower pays off the loan before ownership changes. Confirming the exact amount owed to settle the loan completely is essential.

How to Sell a Financed Car

Selling a financed car involves a few key steps to ensure a smooth process. Start by contacting your lender to determine the exact loan payoff amount and any specific terms for transferring ownership. Once you have this information, check if your car’s value is more or less than the loan balance. This will show whether you need to pay any remaining amount.

Next, find a buyer—this can be a private individual, dealership, or a service like Sell Any Car Fast. If the buyer agrees, they can pay off the loan directly to the lender, ensuring a clean title transfer.

Be sure to prepare all the necessary documents. This includes the title, loan details, and a bill of sale. You need these to complete the transaction. Working with a reputable service or buyer can streamline the process, saving you time and stress.

Potential Challenges of Selling an Encumbered Car

Selling a financed car privately can be rewarding, but it can also be challenging. You may face negative equity and financing issues for buyers.

Once a loan has been paid out, it can take 2-3 business days to clear and another 5 business days for the encumbrance to lift from the PPSR. So allow extra time if you're selling your car to move overseas.

Different registration processes can add to the difficulty. A risk of potential scams also exists. Use secure payment methods and meet in public to ensure safety.

Conclusion

In conclusion, selling a financed car is possible. It can be a simple process if you follow the right steps. Understanding your loan agreement and calculating your payoff amount are important first steps. Working with the right buyer can make a significant impact.

With

Sell Any Car Fast, you can streamline the process and eliminate the stress, as they can pay your loan out directly. This means you can settle your outstanding finance quickly and easily, paving the way for a hassle-free car sale. Whether you're upgrading, downsizing, or selling your vehicle, you can expect a quick, safe, and clear transaction.

Frequently Asked Questions

Can I sell my car with outstanding finance?

Yes, you can sell a car with outstanding finance, but you'll need to settle the remaining loan balance first, or have the buyer pay out the loan directly via a payout letter.

Is it illegal to sell a car with money owing?

In Australia, it is legal to sell a car that still has money owed on it. However, you must tell the buyer about the loan. The borrower must pay off the loan before the title transfers to the new owner.

Usually, the buyer will pay the lender directly. Alternatively, they may pay enough for you to settle the loan before ownership changes hands. Failure to disclose the debt could result in legal and financial consequences for the seller

What is a letter of clear title?

The lender gives you a letter of clear title, also called a lien release letter, after you pay off your car loan. It shows that the lender no longer has a financial interest in the vehicle. This means the car is fully yours.

This letter is important when you sell or transfer the car. It proves the car has no outstanding finance. This helps the new buyer register the vehicle in their name without any legal issues.

Should I release before confirmation from the lender?

Do not release your car until you confirm that you have fully paid off the loan. This will help you avoid repossession. Get a payout letter from the lender for your protection.

Can you transfer a car loan?

Transferring a car loan is complex; lenders may allow it if the new borrower meets credit criteria. Consult your lender for specific terms and conditions.