How to Get The Best Car Finance Interest Rate

If you plan on financing your new or used car, it's essential to explore your loan options and compare rates from different lenders.

December 19, 2024

Understanding Car Loan Interest Rates

Car loan interest rates are a key factor in determining the overall cost of your vehicle financing. These rates show the cost of borrowing money. Many factors affect them. These include the lender's policies, the type of interest rate, and your credit score.

Lower interest rates mean more affordable monthly payments and less interest paid over the life of the loan. It’s essential to understand how interest rates work so you can make informed decisions and choose the best financing option for your budget.

Types of Car Loan Interest Rates: Fixed vs. Variable

Car loans generally come with a fixed interest rate, but it's important to know the difference.

What is a fixed interest rate loan?

A fixed interest rate remains constant over the entire loan term, making it predictable and easier for budgeting.

What is a variable interest rate loan?

A variable rate can change based on market conditions. This can lead to lower or higher payments over time.

Each type has its advantages and disadvantages. Fixed rates provide stability. Variable rates often start lower, which can lead to savings if the market stays favourable.

Knowing the difference can help you pick the loan structure that aligns best with your financial goals.

The 7 Steps to Getting the Better Interest Rate

1. Get Your Credit Score

Your credit score plays a pivotal role in determining the interest rate you'll receive. Lenders use it to assess your creditworthiness. Generally, the higher your credit score, the lower the interest rate you'll qualify for.

Obtain a copy of your credit report and ensure it's accurate. If your score is less than stellar, take steps to improve it before applying for a loan. For your most accurate and detailed credit report and score, head over to Equifax to get your copy and determine if you need to repair your credit rating first.)

If you require a car loan and don't have the resources or time to repair your credit score, you could consider bad credit car loans from specialist providers. These lenders will tailor your credit history to your loan type and assist you in finding a loan suitable for your unique situation.

2. Shop Around for the Lowest Rate

Don't settle for the first financing offer that comes your way. Instead, shop around and compare offers from various lenders, including banks, credit unions, and online lenders.

Each lender may offer different interest rates and terms, so it pays to explore your options. Utilise online comparison tools and solicit quotes to make an informed decision.

3. Consider the Term Length

The term length of your loan can impact your interest rate. Shorter loan terms usually have lower interest rates. However, they also mean higher monthly payments.

Longer loan terms provide lower monthly payments. But they result in higher overall interest costs. Evaluate your budget and financial goals to determine the most suitable term length for your situation.

4. Negotiate Your Interest Rate

Don't hesitate to negotiate the terms of your car finance agreement including the interest rate. Lenders set their rates based on different factors. However, there is often room for negotiation. This is especially true if you have a strong credit history or are a loyal customer.

Be prepared to leverage competing offers and advocate for yourself to secure a better rate. Also, think about talking about other parts of the loan.

This includes the loan term and any possible fees. Doing this can help you get a better financing deal. Doing your research and being well-prepared can significantly impact the overall cost of your car loan.

5. Make a Larger Deposit

A larger down payment reduces the amount you need to finance, which can result in a lower interest rate. It also shows lenders that you are financially responsible. This lowers their risk and may lead to better loan terms.

6. Consider Getting Pre-Approval

Obtaining pre-approval for a car loan can give you a competitive edge when negotiating with dealerships. Pre-approval means you submit a loan application. You then get a conditional approval from a lender. This approval includes details like the maximum loan amount and interest rate.

With pre-approval in hand, you can shop for a car with confidence, knowing your financing is already secured. Keep in mind extra costs like Stamp Duty and Registration when determining your loan amount.

7. Avoid Unnecessary Add-Ons

When financing a car, dealerships may try to upsell various add-ons, such as extended warranties or gap insurance (this is different to comprehensive insurance). While some of these products may be beneficial, they can also increase the overall cost of your loan.

Evaluate each add-on carefully and consider whether its worth the additional expense. By avoiding unnecessary add-ons, you can keep your loan amount and interest rate as low as possible.

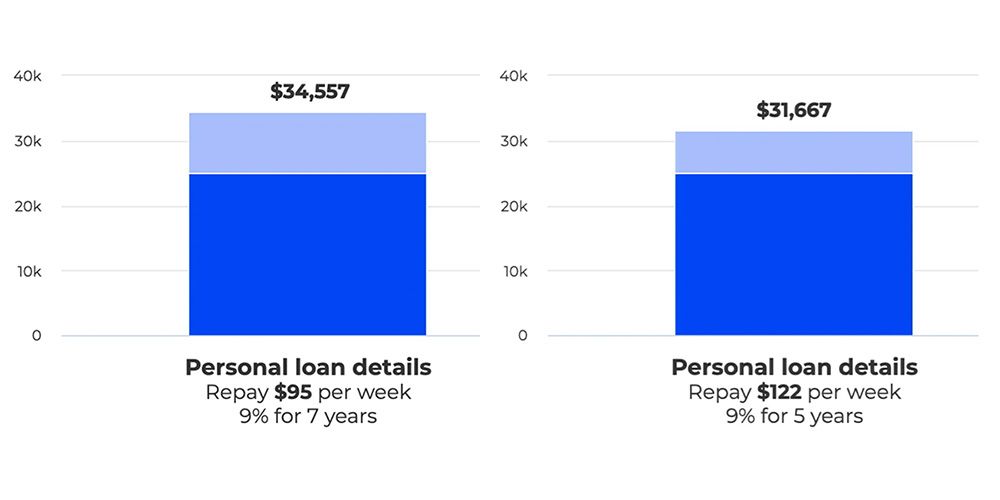

Loan Term Comparison (Example)

Let's take a look at the difference in cost when your loan term increases.

Based on a $25,000 loan amount at 9% interest.

With this scenario in mind, extending your loan term by 2 years will save you a little under $30 per week. However, if you make the minimum repayments for the life of the loan it will cost you a nearly $3,000 more in interest.

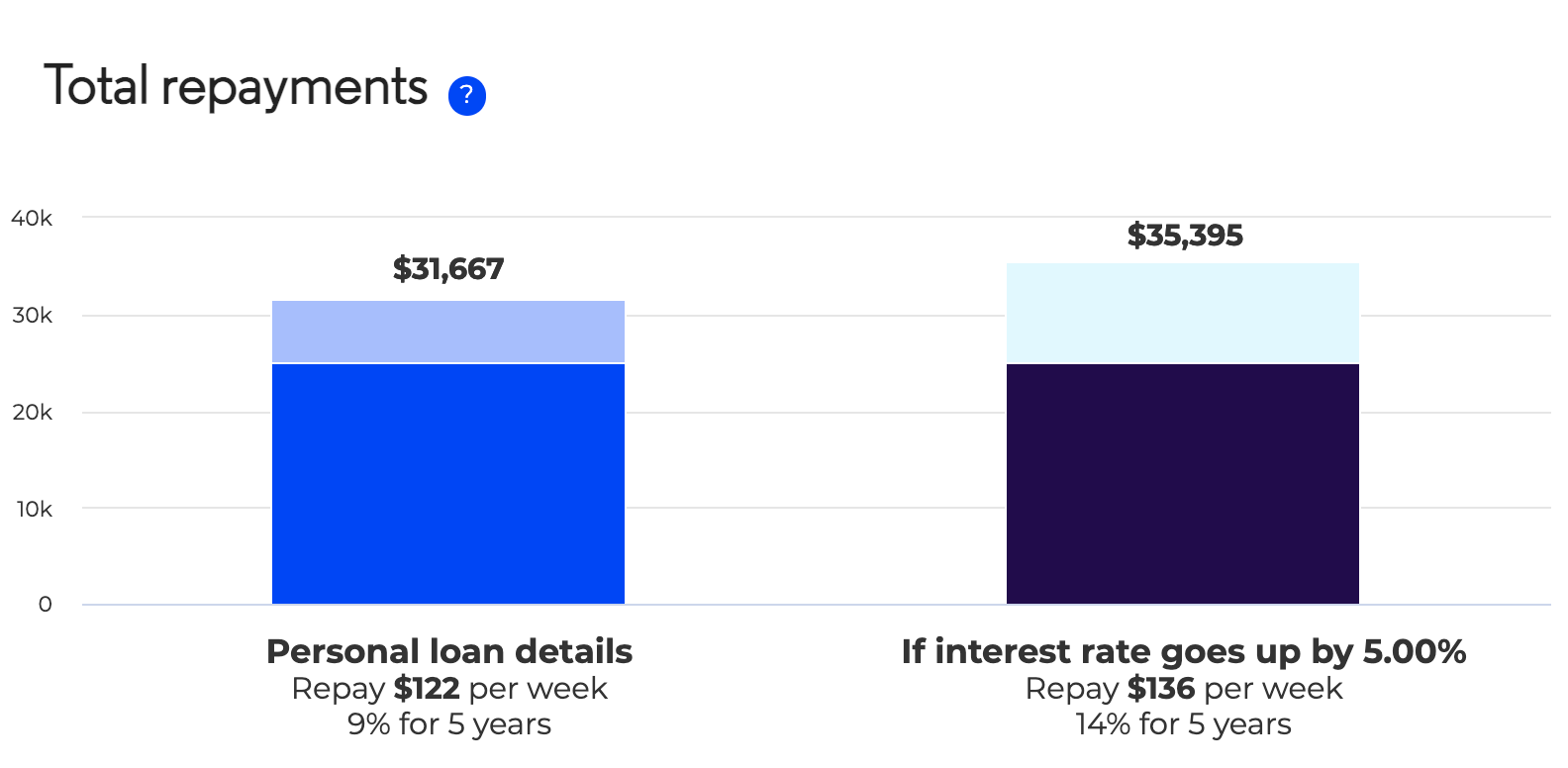

Interest Rate Comparison (Example)

This comparison is based on a 5 year loan term at a loan amount of $25,000. As you can see, a 5% interest rate difference between the two scenarios can cost you almost $4,000.

Car Loan Repayment Calculator

Calculate Monthly Repayments

This calculator is intended as a general guide only and does not constitute a formal loan offer. Results are estimates and do not include fees, charges, or other costs that may be applicable. Please consult with a financial advisor or lender for a detailed quote tailored to your situation.

Frequently Asked Questions

Does My Credit Score Affect the Car Loan Interest Rate?

Yes, credit scores heavily influence car loan interest rates. A higher credit score generally qualifies you for a lower interest rate, as it signals lower risk to lenders.

Can I Negotiate My Car Loan Interest Rate?

In some cases, yes. If you have a good credit history, stable income, and other offers on the table, lenders may be willing to negotiate a lower interest rate to secure your business.

Is Dealer Financing More Expensive Than Bank Loans?

Not necessarily. While some dealerships may offer higher interest rates, others provide promotional financing with lower rates, especially for new cars. It’s best to compare dealer and bank rates to see which offers better terms.

Would a Bigger Deposit Help My Interest Rate?

A larger down payment can reduce the loan amount, which may qualify you for a lower interest rate. It also reduces your monthly payments and total interest paid over the life of the loan.

Final Thoughts

Locking in the best car finance interest rate requires research, preparation, and negotiation. By understanding the factors that influence your rate and implementing the strategies outlined above, you can increase your chances of obtaining favourable loan terms.

Remember to prioritise affordability and choose a loan that aligns with your financial goals. With careful planning, you'll be cruising in your new car with confidence and peace of mind.