What is WOVR in QLD? Written-Off Selling Rules & How to Do a WOVI Check

Find out what WOVR means in Queensland, how it affects selling and registering a car, what WOVI inspections involve, and how to do your own WOVI check.

May 17, 2025

Thinking of Buying or Selling a WOVR Car in Queensland?

If you’ve come across a WOVR vehicle or are trying to sell one, it’s important to know exactly what that means.

In this guide, We’ll explain what WOVR is, how the inspection process works, what to expect if you're buying or selling a car written-off car and how to do a WOVI check.

What is The Written Off Vehicle Register (WOVR)?

WOVR stands for the Written-Off Vehicle Register. It’s a national database that tracks vehicles that have been deemed uneconomical to repair, either due to accident damage, water damage, hail damage or being written off by an insurer.

There are two main types:

Statutory Write-Off

Cannot be registered again, ever.

Repairable Write-Off

Can be re-registered, but only after a WOVI inspection along with a valid roadworthy certificate.

What Is a WOVI Inspection?

WOVI stands for Written-Off Vehicle Inspection. It's required in QLD before a repairable write-off can be re-registered.

Here’s how it works:

- The car must be repaired to meet roadworthy standards.

- You’ll need to book a WOVI through Queensland Transport.

- They’ll inspect the vehicle and check the identity of key parts to prevent rebirthing.

- You can’t just roll up as WOVI bookings are tightly managed.

A WOVI is not the same as a roadworthy certificate - you’ll need both for the car to be re-registered.

WOVR vs WOVI Terms

Can You Sell a WOVR Car in QLD?

Yes, but it depends on the status.

Registered Repairable Write-Off:

You can sell it like any other car but you must disclose that it’s been written off.

Unregistered Repairable Write-Off:

You can still sell it, but the buyer will need to pass a WOVI before it’s registered again.

Statutory Write-Off:

You can only sell for parts or scrap and it can’t ever be registered.

So yes, WOVR cars can be sold, but expect a lower price and more difficulty.

Can You Insure a Repairable Write-Off?

It’s tricky. Most insurers won’t cover WOVR vehicles with comprehensive insurance, even after a WOVI.

You might be able to get:

- Third-party property

- Fire and theft cover

- Or no insurance at all

Be honest with your insurer, or you could end up with a useless policy.

Tips for Selling a WOVR Car in QLD

If you’re selling a WOVR vehicle, here’s how to do it right:

- Be upfront in your ad. Say it’s on the WOVR.

- Show photos of the previous damage and receipts for repairs.

- Mention if it passed a WOVI or roadworthy.

- Sell to someone who understands what WOVR means (like us).

Trying to hide it will just waste your time and invite lowballers.

How to Estimate Your Repairable Write-Off’s Value

Determining how much your repairable write-off is worth can vary, but a common rule of thumb is that it may be valued at roughly two-thirds of the price of a similar non-write-off vehicle, so about 33% less.

Of course, this can depend on factors like the quality of the repair and the reason it was written off in the first place. Below, you’ll find a simple calculator to help you estimate your car’s value as a repairable write-off.

How to Do a WOVI Check

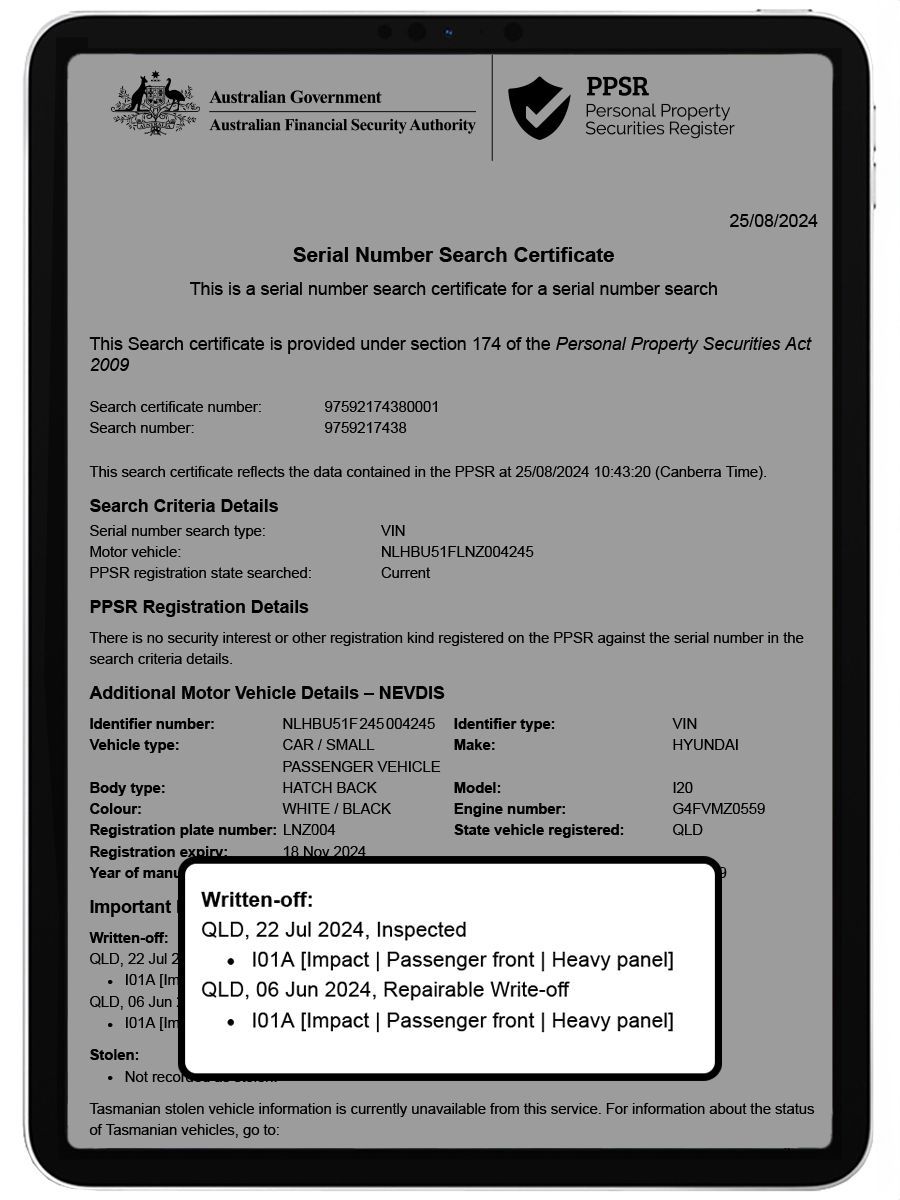

Before you buy or sell, run a quick WOVI check using the Personal Property Securities Register (PPSR) website.

It’ll tell you:

- If it’s a statutory or repairable write-off

- If it passed a WOVI

- If it’s been registered since

Some buyers will check this themselves, so beat them to it.

It's easy to check online and only costs $2. All you need is the cars Vehicle Identification Number (VIN)

Need to Sell a Car on The WOVR?

Don’t want to deal with picky buyers or inspection bookings? We buy WOVR cars as-is, no pressure, no judgement.

Frequently Asked Questions

What Is The WOVR?

WOVR stands for the Written-Off Vehicle Register. It’s a national database that records vehicles that have been written off due to damage.

In Queensland, this impacts whether a car can be re-registered, insured, or legally sold.

What’s the Difference Between WOVR and WOVI?

- WOVR (Written-Off Vehicle Register) is the register where written-off vehicles are recorded.

- WOVI (Written-Off Vehicle Inspection) is a physical inspection required in Queensland before a repairable write-off can be re-registered.

Can You Sell a Car That’s on The WOVR?

Yes, you can sell a WOVR-listed car in QLD, but there are rules.

Repairable write-offs can be sold (with full disclosure), while statutory write-offs can only be sold for parts or scrap.

How to Do a WOVI Check

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

If you're unsure about what steps to take after the WOVI or how to actually list the car, check out our complete guide for selling a car in QLD.